Starting January 1, 2025, all Maine employers with at least one employee must begin payroll withholdings for the state’s new Paid Family and Medical Leave (PFML) program. The first quarterly wage report and premium payment will be due by April 30, 2025, covering wages from the first quarter of the year.

As your payroll provider, Payroll Management can handle the filing and payments on your behalf—but we need your help to get started.

WHAT YOU NEED TO DO

Ensuring compliance is simple, but action is required:

- Register your business on Maine’s PFML online system.

- Grant Payroll Management Third-Party Administrator access to handle tax submissions for you.

HOW TO REGISTER AND GRANT PMI ACCESS

Step 1: Register Your Business

Go to the Maine Paid Family and Medical Leave portal and complete your business registration.

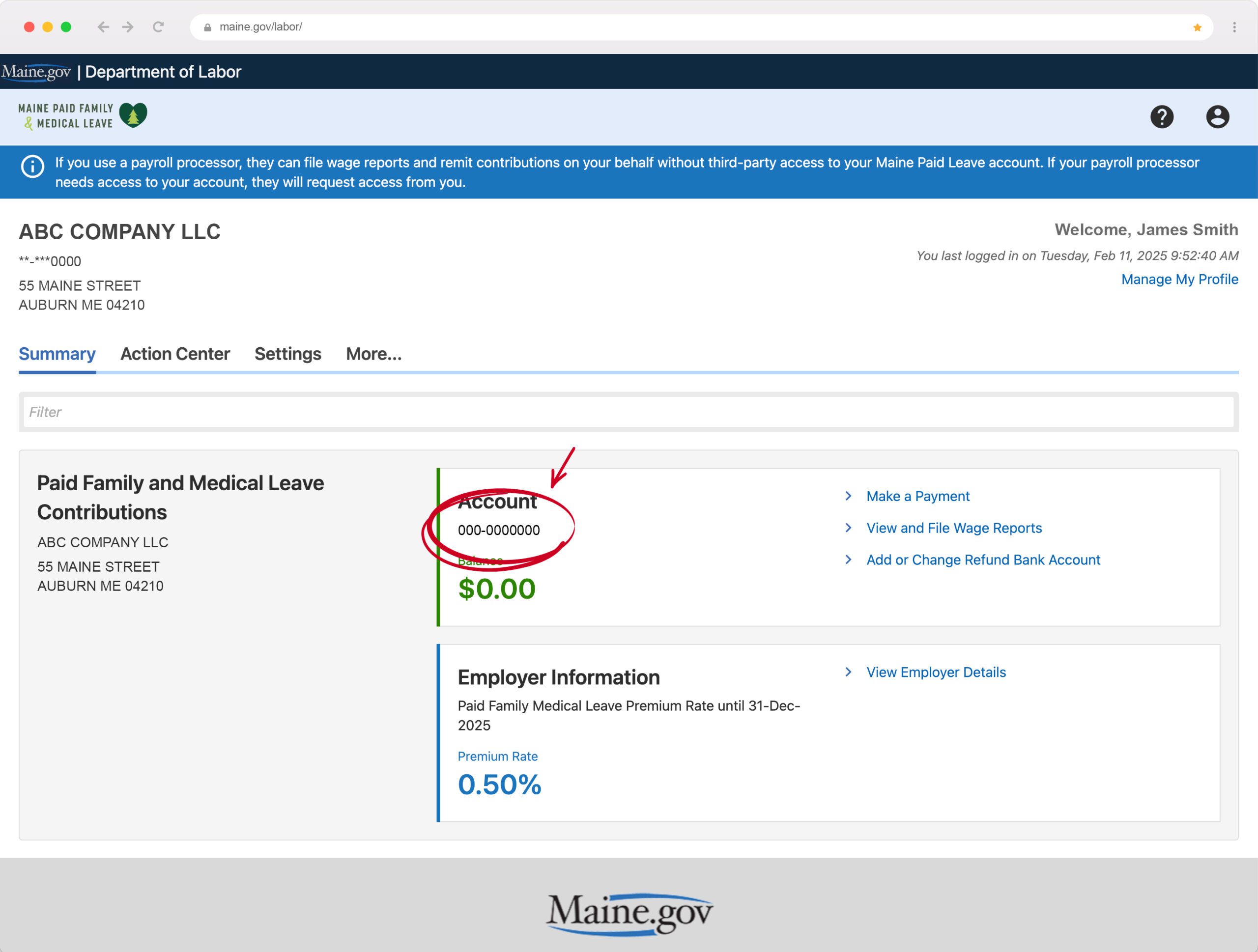

Step 2: Share Your Account Number and Registered Email with Payroll Management

Once registered, locate your account number on the summary page. Complete this brief online form here to share your account number and the email address used to register for the account with Payroll Management.

- After we receive your account number and email address from the online form above, we will request third-party access to manage tax filings on your behalf.

- This process may take 1–2 business days. You will not receive an email notification when the request is made—you’ll need to log in and check manually.

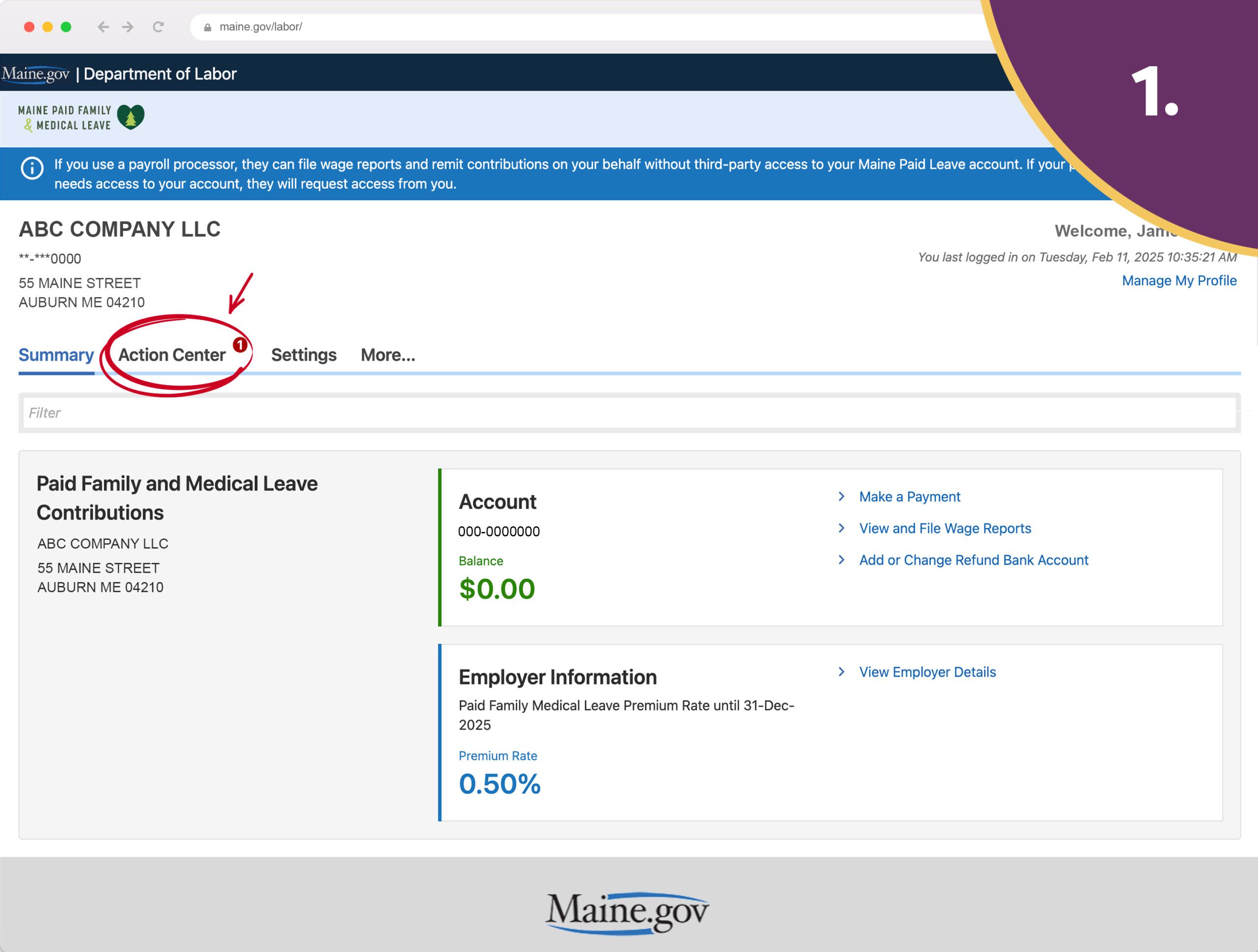

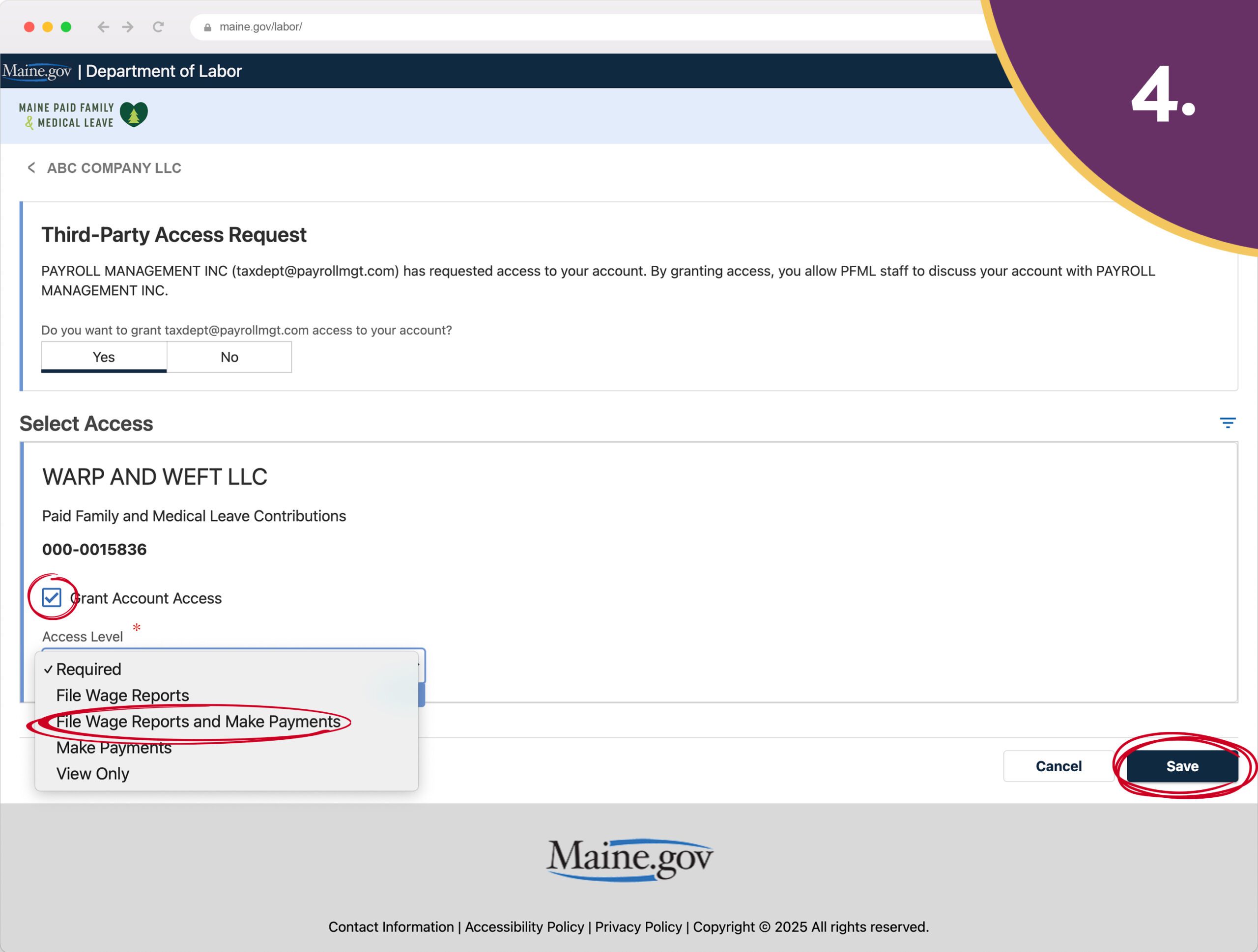

Step 3: Approve Payroll Management’s Third-Party Access

- Log into your account on the Maine PFML portal and click on the “Action Center” tab

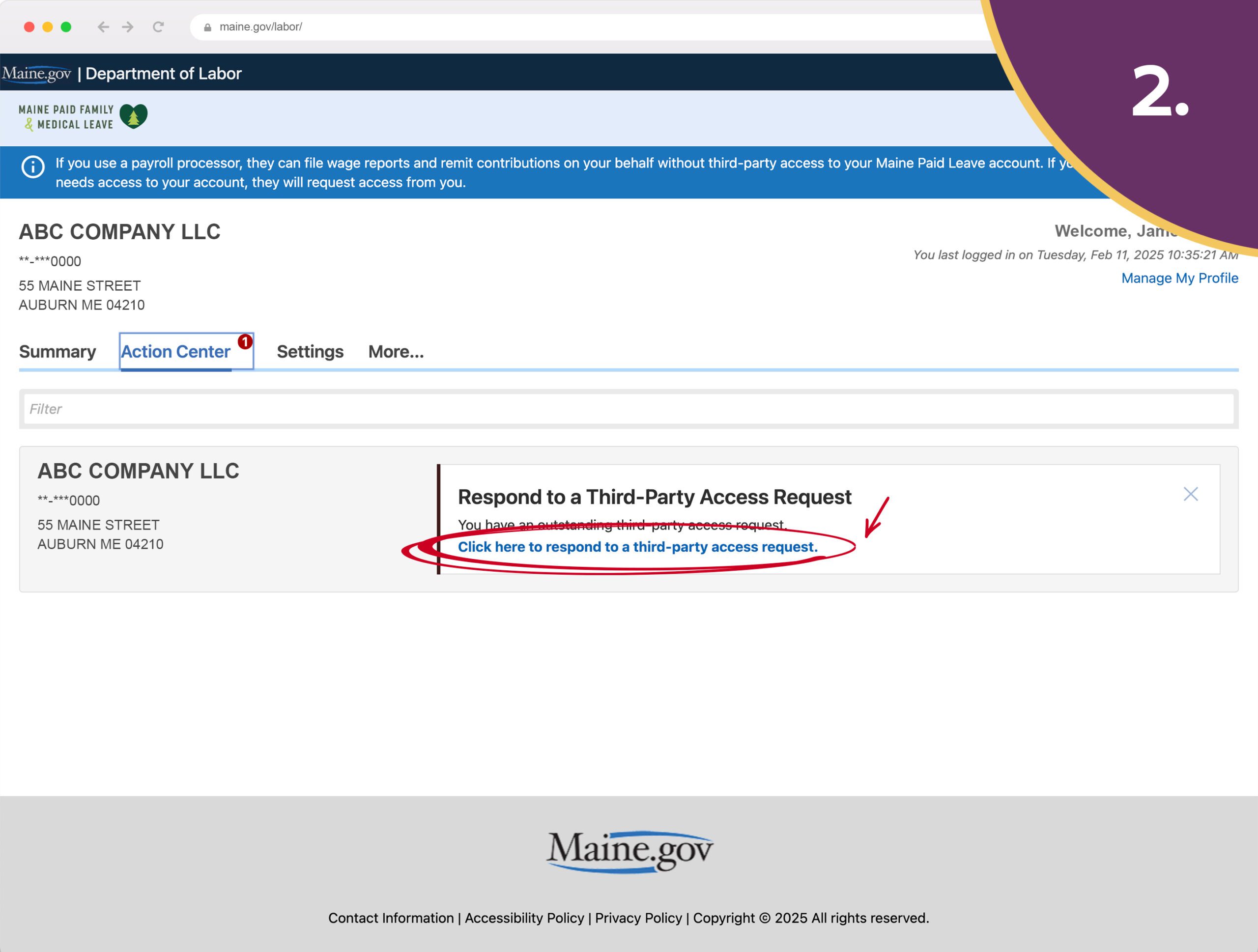

- Look for Payroll Management’s access request and select “Click here to respond to a third-party request”

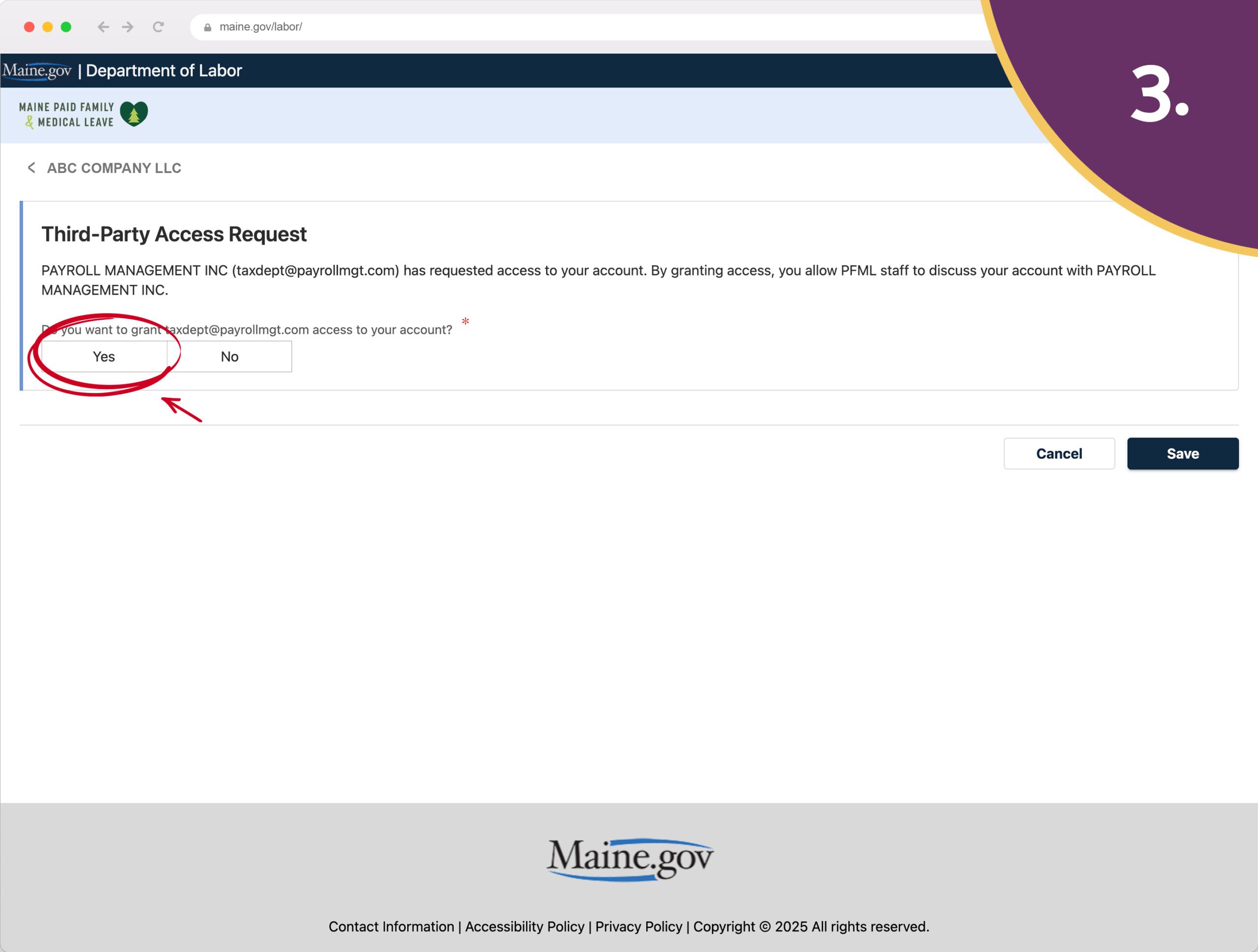

- When the new box appears, select “Yes” to grant access

- When the next box appears:

- Check the box next to “Grant Account Access”

- From the dropdown menu, select “File Wage Reports and Make Payments”

- Click “Save”

- Payroll Management will now be able to file reports and process payments on your behalf.

TAKE ACTION NOW!

To ensure your PFML taxes are submitted on time, please complete these steps as soon as possible—don’t wait until the deadline approaches.